By Frank Long, MS

While financial indicators took a roller coaster ride throughout much of the first quarter of 2020, the purchasing patterns for facility-based equipment (valued at $500 or more) for the PT clinic enjoyed a smooth path upward in the early part of the quarter. This consistent increase in purchasing appears to have been driven by confidence in a healthy market for outpatient clinics, and is a course similar to the results reported in the 2019 survey. The breakout of COVID-19 in the United States during late February and early March 2020, however, may be a factor in whether this buying trend continues. The following analysis outlines where purchasing activity landed as the first quarter wraps up and where it may go if confidence and spending recover.

Ask and Receive

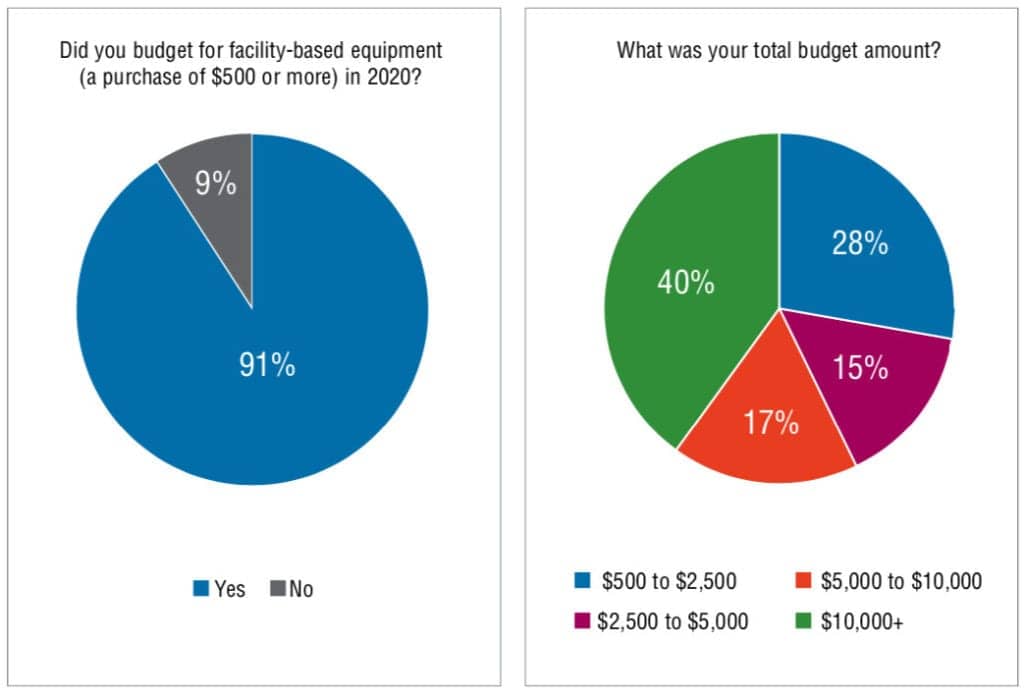

The survey points to a trend toward increased purchases, but the more intriguing question is whether those purchases are directed at replacing aging equipment or helping to fuel business growth. Some of the data suggest the majority of purchases are linked to strategic planning that precedes growth. This idea is supported by responses to the survey question that asks, “Did you ask for a budget in 2020?” Survey-takers responded that 91% had asked for a budget and 86% indicated they received the requested budget.

Another notable trend appeared in the growth of the budget amounts. What made these data stand out was growth among the top range of budgets—those valued at $10,000 or greater. Budgets in this range accounted for 40% of all budgets reported in 2020, which was a jump from only 36.4% in 2019. Budget amounts in the next highest range—$5,000 to $10,000—also grew slightly with 17% of this year’s respondents, indicating their budgets fell into that range compared to only 15% in 2019. Growth in this range is good news for clinics and manufacturers, but it invites analysis about how the money is being spent.

First-Time Buys

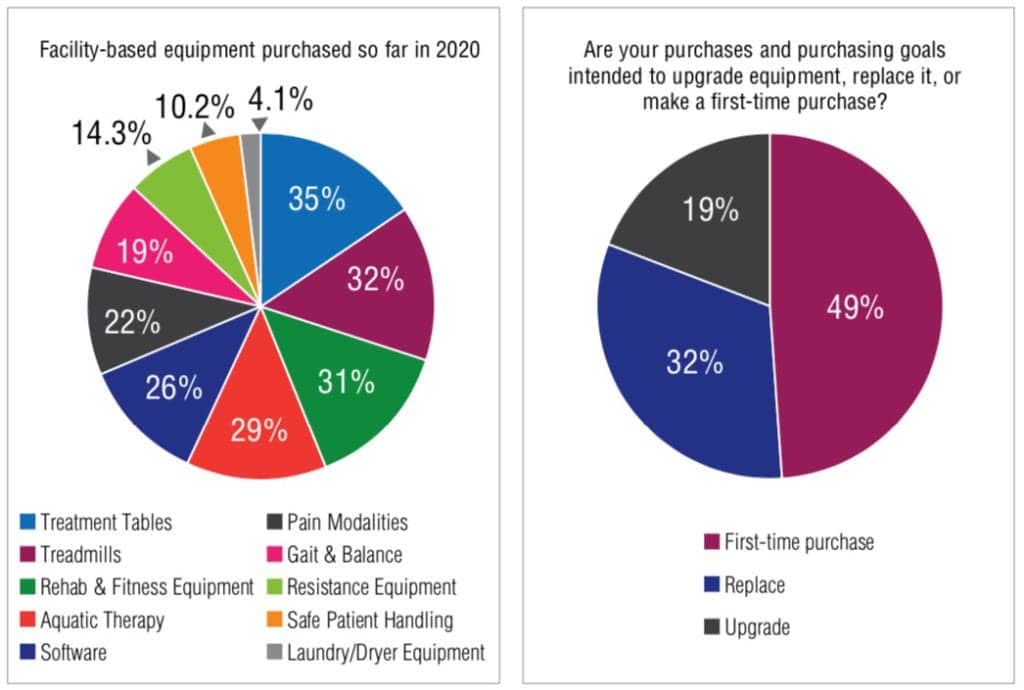

Survey data suggest the majority of purchasing activity has been strategic in nature. That conclusion is drawn from what survey-takers reported about their purchase intention, purchasing goals, and whether those purchases were made for upgrade, replacement, or first-time acquisitions. First-time purchase spending typically suggests that the buyer wants a tool to either protect resources or create revenue. Tools that typically fit that description include gym equipment or advanced technologies designed to treat and manage pain; all of which make a markedly different contribution to the PT clinic than small-cost items such as topicals, wraps, and printer ink.

The survey data reflect the popularity of first-time buys. Among the respondents, 49% indicated their purchases and purchasing goals for 2020 were intended for first-time purchases—up from 45.5% reported last year. Likewise, respondents in this year’s survey noted that 32% of their purchases and purchasing goals were aimed at replacing equipment while 19% reported that their purchase activities were devoted to equipment upgrades.

[sidebar float=”right”width=”250″]Product Resources

The following companies offer a range of products for capital expenditure purchases:

Aquatic Access

www.aquaticaccess.com

Bailey Manufacturing Company

www.baileymfg.com

Battle Creek Equipment

www.battlecreekequipment.com

Biodex Medical Systems Inc

www.biodex.com

Bionik Laboratories Corp

www.bioniklabs.com

Brookdale Medical Specialties Ltd

www.brookdalemedical.com

Dyaco

www.dyaco.com

CIR Systems Inc/GAITRite

www.gaitrite.com

Clarke Health Care Products

www.clarkehealthcare.com

Dynatronics

www.dynatronics.com

Everyway4all

www.everyway4all.com

First Degree Fitness (Fluid Power Zone)

www.firstdegreefitness.com

FOTO Inc

www.fotoinc.com

Gorbel Rehabilitation

www.gorbelrehabilitation.com

Hausmann Industries Inc

www.hausmann.com

Hocoma

www.hocoma.com

Hudson Aquatic Systems LLC

www.hudsonaquatic.com

HydroWorx

www.hydroworx.com

Interacoustics

www.interacoustics.com

LightForce Therapy Lasers by LiteCure LLC

www.litecure.com

Pivotal Health Solutions

www.pivotalhealthsolutions.com

ProtoKinetics

www.protokinetics.com

Solo-Step Inc

www.solostep.com

Sprint Aquatics

www.sprintaquatics.com

SwimEx Inc

www.swimex.com

SureHands Lift & Care Systems

www.surehands.com

Tekscan Inc

www.tekscan.com

Thought Technology

www.thoughttechnology.com

Tri W-G Inc

www.triwg.com

Vista Medical

www.vista-medical.com

Vonco Medical

www.voncomed.com[/sidebar]

Highlights: Buy vs Want

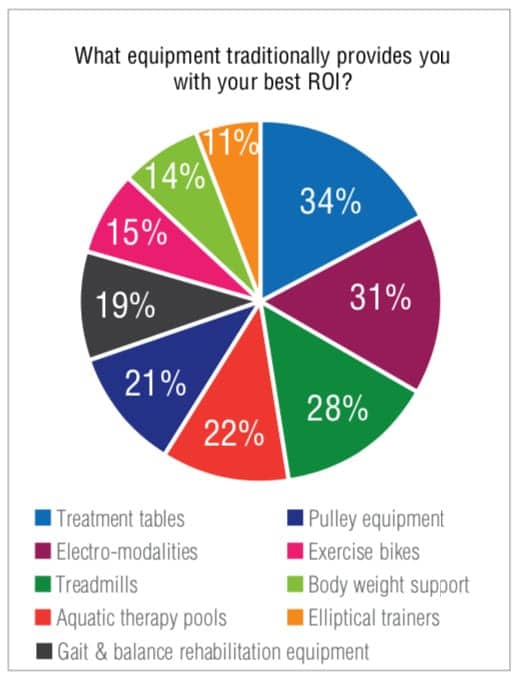

Some of the strongest purchasing activity occurred among the workhorse equipment for the PT clinic where treatment tables emerged as a clear favorite. These products are expected to offer long-term value and durability that stand up to frequent use, which positions them as a reliable investment if not one that is mission-critical.

Treatment tables were the product most often named as facility-based equipment purchased so far in 2020 with 35% of survey-takers indicated they had made such a purchase. The second-most frequent purchase so far in 2020 was for treadmills (32%) followed by rehab and fitness equipment (31%), aquatic therapy equipment (29%), and software (26%). Other purchases the respondents reported making in 2020 included pain modalities (22%), technologies for gait and balance (19%), resistance equipment (14.3%), safe patient handling equipment (10.2%), and laundry/dryer equipment (4.1%).

Treadmills and conditioning equipment designed for therapeutic use with the lower extremities outpaced purchasing for these same products last year. The survey-takers in the 2020 poll indicated that 32% had purchased treadmill equipment, up slightly from 31.6% in 2019. Some of the models our readers specified in their qualitative responses were from manufacturers such as Clarke Health Care Products Inc, Oakdale, Pa; SCIFIT, Tulsa, Okla; and Woodway, Waukesha, Wis.

Wish List

A good survey should be more than an organized data dump. It should measure reported activity throughout the market and provide some intelligence about where purchasing is headed in the future. These data can help predict whether buying patterns will remain steady or draw attention to a potential shift. One of the best places to find this information is in the responses our survey-takers offered about their “wish lists.”

While some of the items on the wish lists offered specialized functions that would be at home in a clinic serving a niche population—eg, women’s health or running analysis—in general, they included products that would be appropriate for outpatient clinics treating a mixed population. Among the survey responses several common items appeared which suggest similar thinking among many clinicians and hinting at the possibility that demand could increase. Among them, body weight support systems were identified by 23% of survey respondents as wish-list items. Some of the technologies those survey-respondents specified were the SafeGait 360 Balance and Mobility Trainer from Gorbel Rehabilitation, Victor, NY; the Lokomat and Andago from Hocoma Inc, Norwell, Mass; and the LiteGait from Mobility Research, Tempe, Ariz.

Also among respondents, 21% noted that their wish lists included electronic gait evaluation technologies such as the Zeno Walkway from ProtoKinetics, Havertown, Pa, and GAITRite from CIR Systems Inc, Franklin, NJ. Additionally, 19% specified therapeutic laser equipment such as the LightForce EX from LiteCure, New Castle, Del, and the Apollo Laser System from Pivotal Health Solutions Inc, Watertown, SD, as wish list items.

Responsible Purchasing

While quantitative data is the mainstay of this survey, the qualitative data it captures sketches out some important insights. For example, this year’s survey marked the first time that significant numbers of respondents noted that “buying green” was important, and indicated that consideration about a product’s environmental impact was part of the purchase process. Several respondents also noted they had internal discussions about chemistry, water quality, and water usage associated with aquatic therapy equipment prior to purchase, while others reported they had made thoughtful evaluation about the materials used for treatment table coverings and cushioning prior to purchase. Likewise, some respondents indicated that proper breakdown and disposal of the components found in computerized products was important.

Reliable Sources

Near the beginning of the new millennium when online technologies for consumer use came into widespread use, they revolutionized the speed with which information could be consumed. Within a few years that paradigm change was supplanted by another revolution: the arrival of social media and its nearly ubiquitous adoption — especially among younger populations. With so many information sources now available, our survey once again sought to understand which sources readers say they rely on to gather information about facility-based equipment and physical therapy products. The results of the 2020 survey show that websites and other online platforms continue to be the leading source for this type of information with 88% of readers indicating they turn to these destinations for product-related content. Newsletters were identified as a frequent source for information by 46% of survey respondents while 39% indicated magazines/digital editions/media. Among those who completed the survey, 32% reported they had gotten information from a referral while 31% indicate social media as their source for information, followed by word of mouth (22%) and employees (8%).

Things Change

As this issue goes to press, the world economy is responding to effects of the pandemic associated with COVID-19. Up to this point, world economies have been relatively strong; and in the United States, especially, employment and capital purchasing have been good. Whether that trend remains unbowed by the turmoil caused by this novel microbe strain will play out over the spring and summer. Its appearance nonetheless offers a moment that is as teachable as it is timeless: omnia mutant. This simple truth translated from Latin means, “everything changes.” For several years now, the physical therapy profession has been in relatively prosperous times despite fluctuations from third-party payors and stinging cuts to Medicare reimbursement. Bearing that in mind, no economy is ever so good that it should cloud the fact that good times are ephemeral. Things will change, and those who can thrive in any economy are those who came prepared. PTP

Frank Long, MS, is Editorial Director of Physical Therapy Products. For more information, contact [email protected].